Walmart has quietly widened its online marketplace, moving beyond everyday bargain items to authenticated, higher-priced luxury and collectible items.

Earlier in August, more than fifty Pop Mart Labubu figures and other Monsters-series collectibles were found on the chain’s third-party marketplace through StockX, many priced above $200.

Industry experts say the move extends Walmart’s reach past time-limited direct “drops” to a broader cross-channel marketplace strategy. Learn more here.

Related: How to Determine Authentic Sports Memorabilia From Fakes Online

Resale Partners and Walmart

Third-party resale partners are now an explicit part of Walmart’s playbook. The company first partnered with sneaker resale marketplace StockX in 2024 to bring pre-verified sneakers onto its marketplace.

Walmart’s Marketplace vice president told Bloomberg that the arrangement could expand to “tens of thousands” of products. In January, Walmart also started carrying Rebag’s full catalog of roughly 27,000 pre-owned, authenticated luxury handbags, watches, and jewelry.

Collectibles Section

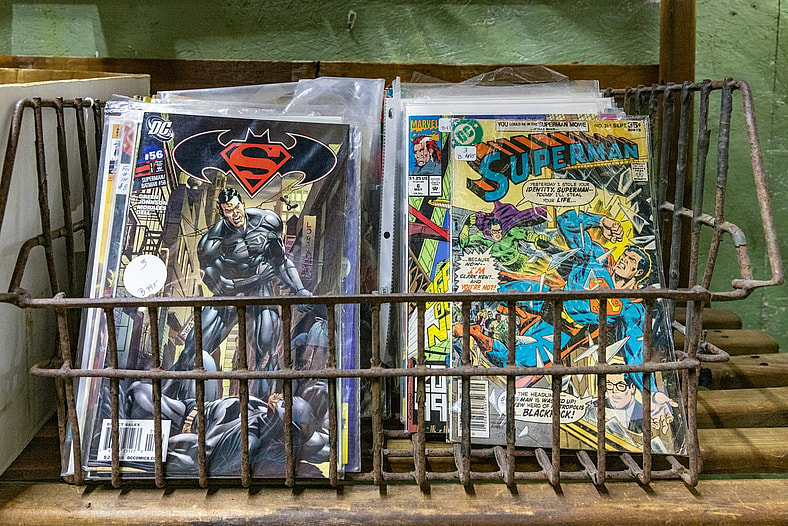

Walmart’s changes underscore the company’s strategy of diving into the collectibles industry. In 2024, Walmart created a collectibles section on its marketplace to group toys, trading cards, sports memorabilia, and other enthusiast items all in one place.

This unit sits under Bob Means, a former eBay trading-cards executive who now serves as general manager of electronics, toys, and seasonal.

These partnerships are a way to surface in-demand brands and items customers are already searching for, even if they don’t expect to find them on their local Walmart page.

Check Out: Hershey Biopic Props Go Up for Auction in One of Hollywood’s Latest Period Sets

Upside to Wealthier Shoppers

There could be an upside to having wealthier shoppers perusing the chain’s shelves. Scott Benedict, a retail consultant and former Walmart buyer, told Modern Retail that attracting customers who make $100,000 or more could create a pathway to selling everyday basics, groceries, and consumables alongside premium purchases.

Resale partners connected to Walmart also benefit. Rebag’s CMO Elizabeth Layne said the deal was “all about the reach and building awareness for us,” using the partnership as a way to introduce authenticated luxury items to a much larger audience.

As for Walmart, the business logic is straightforward: drawing collectors and luxury shoppers can increase overall site traffic and expand advertising revenue across a more lucrative demographic.

However, success will depend on more than just inventory counts. Proper authentication, fulfillment quality, curated merchandising, and brand relationships will determine whether Walmart becomes a destination for affluent shoppers and collectors.

Challenges

As with any big pivot, there come obvious challenges. Luxury and prestige brands, and even some collectors, prize a tightly controlled distribution, and many labels have been reluctant to sell through mass retailers in the past.

Sky Canaves, a principal retail and e-commerce analyst, told Modern Retail that, “Walmart will be just as — if not even more — challenged” than Amazon has been in winning over the trust and participation of luxury houses, since the definition of luxury hinges on exclusivity of items. Others point out the large cultural barrier between high-end manufacturers and bargain-based Walmart stores other other mass chains.

Competition is intensifying, though, when it comes to third parties and partnerships, as Amazon made a deal with Rebag in June 2025 to sell tens of thousands of authenticated items.

This not only underscores the importance of resale platforms, but also the decision to pursue multi-channel distribution even when the question of how prestige products should be presented still hangs in the balance.

Also Read: Pop Mart’s Labubu Craze Propelling the Company as Overseas Sales Soar

Impact on Shoppers

For current Walmart shoppers and new collectors, both groups should be prepared for fluctuation. Resale inventory often moves quickly, and changes are made even more so.

As the grocery chain deepens its partnerships with authenticated resale platforms and third-party listings, the industry will be watching to see whether bargain items and luxury pieces can coexist on one platform, and whether it will reshape the exclusivity that embodied the collector’s realm.