Investing money is scary, but with the right plan, understanding, and patience, you could set yourself up for a nice future by investing and saving. But of course, there is always a risk when it comes to this, like when the stock market crashes.

Crashes can happen without warning most times when there’s a significant decline in stock prices. And while the stock market acts in mysterious ways, which downturns have been the biggest stock market crashes in history?

Related: Biggest Cyber Attacks in History

1973-74 Stock Market Crash

One of the biggest stock market crashes in history goes to the 1973 crash between January 1973 and December 1974.

This crash affected all major stock markets in the world, particularly in the United Kingdom, and was one of the worst downturns since the Great Depression. The crash was caused after the collapse of the Bretton Woods system and the United States dollar devaluation under the Smithsonian Agreement.

Read More: Forgotten Historical Figures We’re Revisiting

2020 COVID-19 Crash

The most recent and one of the biggest stock market crashes in history belongs to the year the pandemic hit.

February 2020 saw the markets across the world crashing after the growing instability of COVID-19 which ended in April 2020. While short-lived, the Dow lost 37% of its value. March 16 alone saw the Dow lose a whopping 12.8%. The crash was so large and fast that it triggered trading halts.

The worst-hit stocks affected travel, such as cruise lines, air carriers, and energy companies. But the stock market rebounded well and was a record-setting boom afterward.

Check Out: Most Dangerous Places in the World: From Hell’s Door To Snake Island

Recession of 1937-38

The 1937 recession occurred during the Great Depression in the United States and is one of the biggest economic downturns in history.

By spring of 1937, production, profiles, and wages had regained their early 1929 levels and unemployment was high. This downturn lasted 13 months with industrial production declining almost 30%, with production of durable goods falling faster.

The economy began to start recovering in mid-1938, however employment didn’t rise until the United States entered World War II in late 1941.

Related: Most Controversial Movies Ever Made

Japanese Asset Bubble Burst

Moving away from the United States, the Japanese Asset Price Bubble went from 1986 to 1991 when real estate and stock market prices were inflated, but then burst in 1992.

The bubble was due to the rapid acceleration of asset prices and overheated economic activity thanks to the Bank of Japan’s (BOJ) delayed action to address the issue of tightening the monetary policy.

The economic decline continued for more than a decade and contributed to what many call the Lost Decade.

Read More: Historical Pieces of Civil War Memorabilia

Kennedy Slide of 1962

One of the biggest stock market crashes in history is the Kennedy Slide of 1962, also known as the Flash Crash of 1962 which went from December 1961 to June 1962.

The crash was during the Presidential term of John F. Kennedy and happened after the market experienced decades of growth since the Crash of 1929.

During this period, the S&P 500 declined 22.5% and the stock market did not experience a stable recovery until after the Cuban Missile Crisis. The Dow Jones Industrial Average fell 5.7% which was the second-largest decline at the time.

Check Out: Most Famous Swords in History

Black Monday Crash of 1987

Black Monday, October 19, 1987, saw global stock exchanges plunging, leading to an estimated loss of $1.71 trillion.

This plunge was led by Standard & Poor’s (S&P) 500 Index and Dow Jones Industrial Average (DJIA) in the U.S., a strain that sent world markets tumbling, primarily due to programmatic trading and investor panic.

In response, each nation pursued a monetary policy to help maintain predictable exchange rates with other currencies and price stability. This was implemented to ensure there wouldn’t be another panic and create yet another crash.

Related: Hardest Math Problems In The World (Unsolved)

Dot.Com Bubble Burst

Another bubble that ballooned during the late 1990s and peaked in March 2000 is the Dot.Com Bubble or Dot.Com Boom. This market growth was due to the widespread adoption of the World Wide Web and the Internet, resulting in a dispensation of available venture capital.

Between 1995 and 2000, investments in the NASDAQ composite stock market index rose by 800% only to fail to 78% from its peak in 2002, giving up all its gains during the bubble.

During this, many online shopping companies like Pets.com, NorthPoint Communications, and Global Crossing failed and shut down. Larger companies like Amazon lost large portions of their market capitalization.

Read More: Most Expensive Signatures in History

Panic of 1907

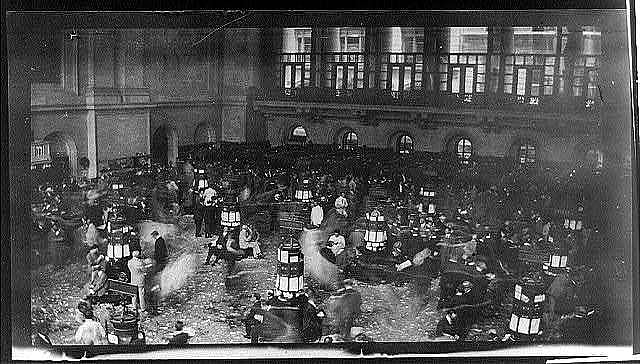

Also known as the 1907 Bankers’ Panic or Knickerbocker Crisis, the Panic of 1907 was one of the biggest stock market crashes in history.

The crash spanned over three weeks starting mid-October when the New York Stoch Exchange suddenly fell about 50% from its peak the previous year. This occurred during a time of economic recession that affected banks and trust companies.

This panic spread throughout the country when many state and local banks and businesses entered bankruptcy. The cause included a retraction of market liquidity by several banks and a loss of confidence among depositors, worsened by unregulated side bets at bucket shops.

Check Out: Most Expensive Video Games In History

Financial Crisis 2007-2008

The financial crisis between 2007 and 2008 was the most severe worldwide economic crisis since the Great Depression and was the cause of the 2008 Great Recession.

This economic slump began when the U.S. housing market collapsed, causing the failure of several major investment and commercial banks, mortgage lenders, insurance companies, and savings and loan associations.

The recession was caused by the central bank of the United States, the Federal Reserve, to reduce the federal funds rate which enabled banks to extend consumer credit at a lower prime rate and encouraged them to lend even to high-risk customers at higher interest rates. Banks were also able to offer subprime customers mortgage loans and even sold them as bonds to other banks and investors.

Related: Strangest Super Bowl Facts From NFL History

The Crash of 1929

The biggest stock market crash in history was in 1929, also known as the Great Crash or the Crash of ’29 beginning in September and ending in mid-November.

This crash is often associated with the worldwide Great Depression, however, financial historians believe there isn’t enough evidence to support this idea. While it didn’t last as long as the others on the list, it had the most devastating and long-lasting effects on the others.

The crash is associated with October 24, 1929, also known as Black Thursday, where some of the largest sell-off of shares in U.S. history when investors traded some 16 million shares on the New York Stock Exchange in a single day.

Read More: What Is the Oldest Castle in the World?